No products in the cart.

US accounts for over 40% of global Bitcoin hashrate

Is the U.S. Dominating Bitcoin Mining? A Deep Dive Into Hasrate and Mining Pools

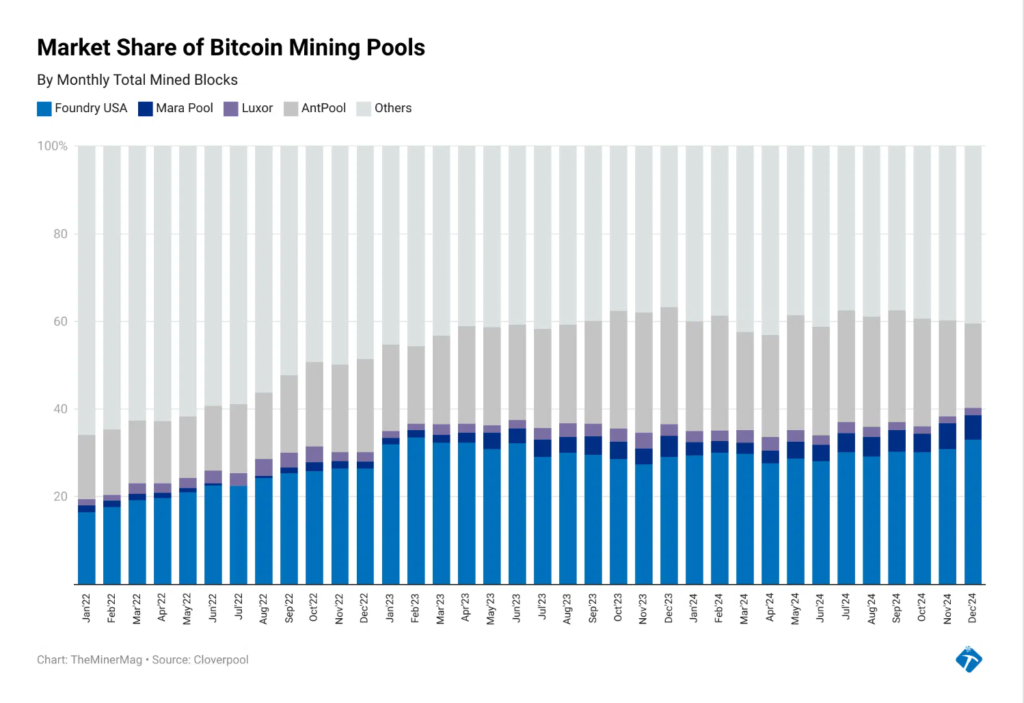

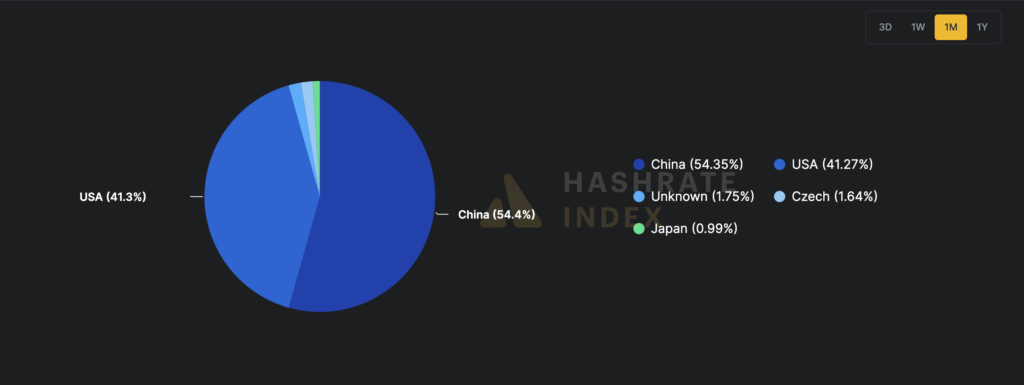

As of late 2024, the United States accounted for more than 40% of the Bitcoin network’s global hashrate — the total computing power that secures the Bitcoin protocol. Notably, two major U.S.-based mining pools, Foundry USA and MARA Pool, were responsible for over 38.5% of all mined Bitcoin blocks.

Foundry USA, in particular, has made significant strides in its hashrate. At the beginning of 2024, the pool was operating at 157 exahashes per second (EH/s). By December, it had surged to around 280 EH/s, making it the largest mining pool globally, with control over approximately 36.5% of Bitcoin’s total hashrate.

Meanwhile, MARA Pool, currently operating at about 32 EH/s, contributes to roughly 4.35% of the network’s total hash power. However, despite these significant increases, Chinese mining pools continue to control the majority of the global hashrate, despite the 2021 ban on cryptocurrency mining in China.

Chinese Mining Pools and Their Continued Dominance

Although the 2021 ban on cryptocurrency mining in China caused a shake-up in the industry, Chinese mining pools have managed to maintain control over a large portion of the global hashrate. CryptoQuant’s CEO, Ki Young Ju, noted in September that Chinese mining pools still account for 55% of the global hashrate. This is largely due to the ability of Chinese miners to bypass the ban using virtual private networks (VPNs) and peer-to-peer apps that allow them to circumvent the national firewall and continue mining.

Despite the international distribution of mining power, determining the true dominance of mining pools is difficult. Even if a pool’s headquarters is based in one country, miners from around the world often contribute to its overall hash power, complicating the assessment of global hashrate control.

Concerns About Centralization of Bitcoin Hashrate

The concentration of mining power into a few large mining pools has sparked concerns about the decentralization of Bitcoin. Rajiv Khemani, CEO and co-founder of mining chip manufacturer Auradine, expressed concerns in October about the implications of this centralization, noting that it could impact Bitcoin’s integrity and national security. Khemani warned that critical infrastructure, such as ASIC chips, should not be confined to a single country, as this could create potential supply chain risks and undermine the currency’s decentralized nature.

The debate over the centralization of Bitcoin’s hashrate continues to evolve, with many questioning whether it could lead to vulnerabilities in the network’s security and long-term stability.

Interested in Getting Into Crypto Mining?

If you’re looking to dive into the world of crypto mining, now is the perfect time to start. The U.S. has quickly become a global leader in Bitcoin mining, with impressive advances in both hashrate and mining technology. Whether you’re interested in mining Bitcoin, Ethereum, or other cryptocurrencies, it’s a great way to get involved in the digital currency space. That said, it’s important to be aware of the competitive landscape and the challenges you’ll face, such as power consumption, equipment costs, and market volatility.

Start with the basics, scale up gradually, and as you gain more experience, you’ll be in a solid position to leverage the opportunities in this fast-growing industry. Ready to start? Check out our product page to find the tools you need to get going!