No products in the cart.

Digital Currency Group spins out new crypto mining subsidiary

Fortitude Mining: DCG’s New Cryptocurrency Mining Subsidiary After Restructuring

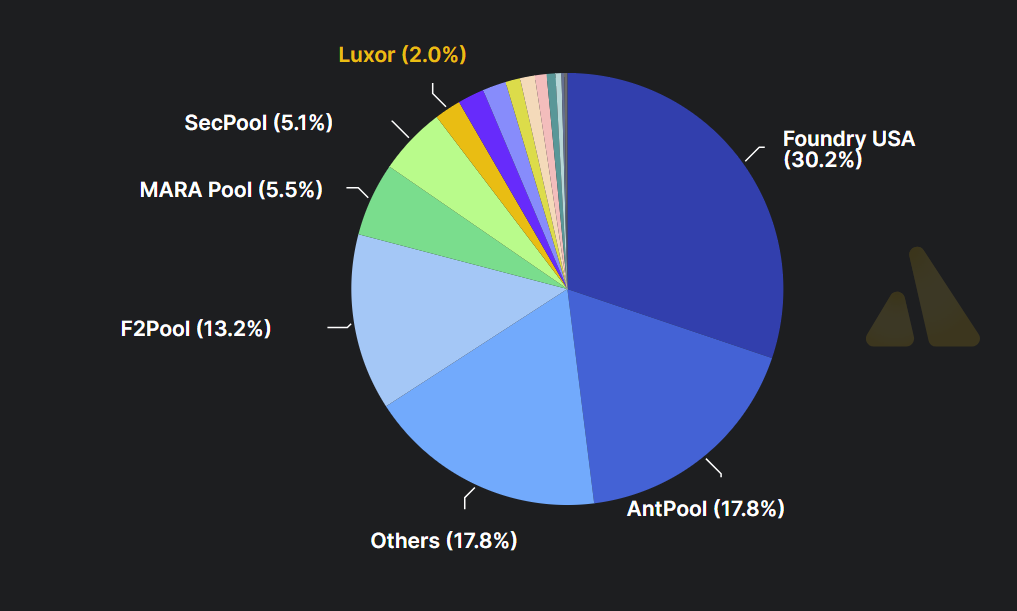

Despite spinning off Fortitude Mining, Foundry continues to hold the title of the largest Bitcoin mining pool, contributing over 30% of the network’s hashrate. In a strategic move to expand its influence in the cryptocurrency space, Venture capital firm Digital Currency Group (DCG) has launched Fortitude Mining as its new cryptocurrency mining subsidiary, signaling its ambition to offer institutional investors diverse exposure to a range of mined digital assets.

As announced on January 29 via the X social media platform, Fortitude Mining has now become DCG’s independent mining business. Previously, the mining operation was integrated into Foundry, a leading decentralized mining and staking service. Fortitude Mining lists Andrea Childs as its CEO, who had previously joined Foundry in 2020 and took charge of the new subsidiary as part of DCG’s broader restructuring strategy.

This creation of Fortitude Mining aligns with Foundry’s recent restructuring efforts. In December, Foundry made a significant move by laying off 16% of its U.S. workforce to refocus on its core operations in Bitcoin mining. Presently, Foundry is still responsible for operating the largest Bitcoin mining pool, which accounts for over 30% of the network’s total hashrate, maintaining its dominant position in the industry.

Bitcoin Mining Post-Halving: New Challenges and Strategic Shifts

The Bitcoin mining industry has faced significant shifts since the network’s fourth halving in April 2024. According to reports from Galaxy Digital, there was a recorded $460 million in reverse mergers and acquisitions during the first half of 2024, signaling consolidation within the industry. These moves highlight the mounting pressures smaller players face due to the evolving economics of Bitcoin mining.

Additionally, Architect Partners pointed out that M&A activity among Bitcoin miners has increased, with larger companies seeking to expand their data center capacity and secure cheaper energy sources. In response to these new challenges, publicly traded Bitcoin miners, such as MARA Holdings, Riot Platforms, and Hut 8, have adjusted their business strategies. Many have decided to accumulate larger Bitcoin reserves instead of liquidating their mined coins. A January 7th report from Digital Mining Solutions and BitcoinMiningStock.io revealed that, post-halving, four of the 16 largest Bitcoin holders are now miners.

The shift towards accumulating mined Bitcoin reflects a larger trend in the crypto mining space, where companies are rethinking their short-term profit models in favor of longer-term strategies aimed at securing more substantial reserves of Bitcoin.

Why Bitcoin Mining Remains a Lucrative Opportunity

Bitcoin mining is more than just a way to earn cryptocurrency. It’s a key part of securing the Bitcoin network, and it allows miners to earn rewards by validating transactions and adding them to the blockchain. As Bitcoin’s price continues to fluctuate, Bitcoin mining can still be a highly profitable venture when paired with the right equipment, infrastructure, and energy sources. Those looking to enter or scale their Bitcoin mining operations need to ensure they are investing in high-quality, energy-efficient hardware.

For more information on the best Bitcoin mining equipment for your operations, visit our product page to discover top-tier solutions like the Volcminer D1 Hydro, designed to help you maximize your mining efforts.