No products in the cart.

Bitcoin Hashrate Hits All-Time High Defying Analyst Expectations

Bitcoin Transaction Fees Hit Multi-Year Lows Amid Record Hash Rate

Bitcoin transaction fees have reached multi-year lows, even with the price hovering around $100,000, highlighting a significant shift in the market. Despite the high price of Bitcoin, the transaction fees for miners have dropped, causing concerns about the future profitability of mining operations.

Key Points to Know:

- Bitcoin’s hash rate has hit a new all-time high, reaching 833 exahashes per second (EH/s) based on a seven-day moving average.

- Bitcoin transaction fees have fallen to their lowest levels in years.

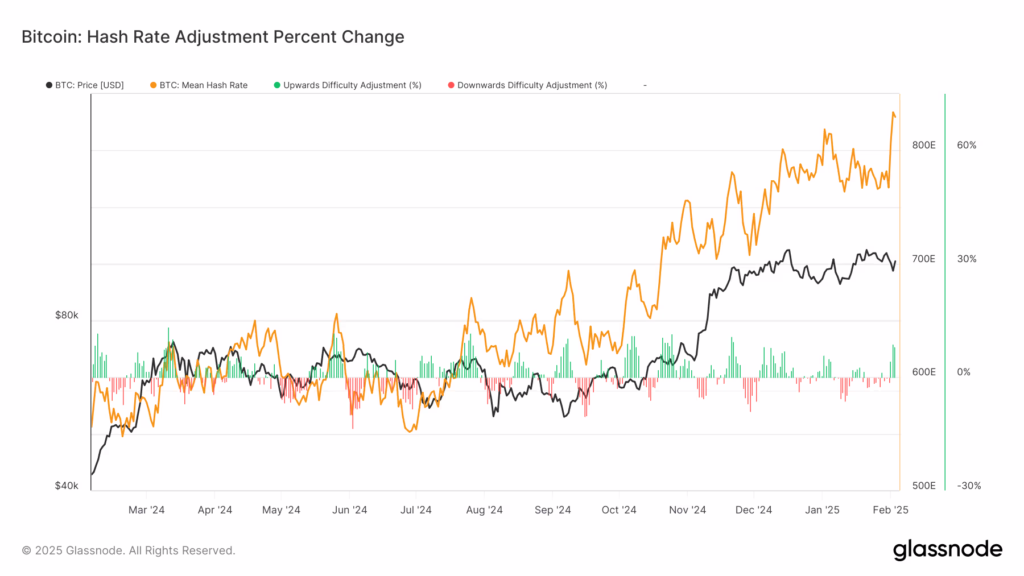

According to data from Glassnode, Bitcoin’s hash rate has surged to a record high of 833 EH/s, marking a 9% increase from the previous 767 EH/s. This boost in hash rate signifies a major leap in the computational power used to secure the Bitcoin network, contributing to higher network security. As more miners contribute their computational power, Bitcoin’s network becomes more robust and harder to attack.

Bitcoin Mining Trends and Pre-Halving Impact

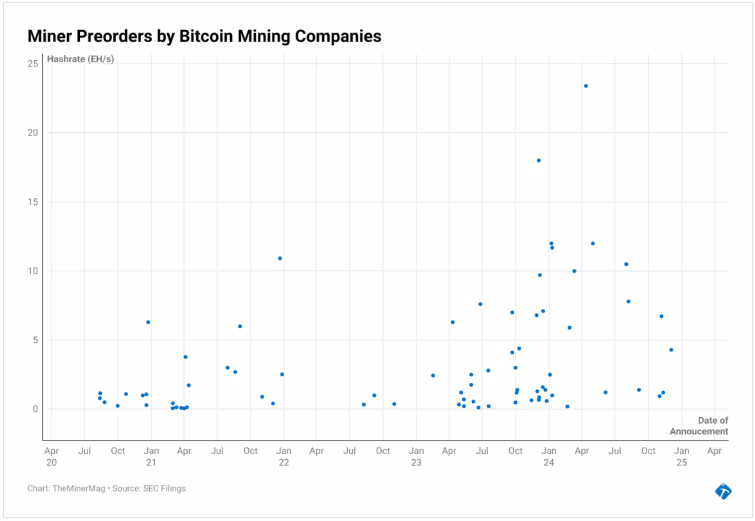

The surge in Bitcoin’s hash rate comes ahead of Bitcoin’s halving event in April 2024, which reduces the block reward for miners by 50%. In preparation for the halving, many mining companies ramped up their hardware purchases. However, Miner Mag reports a decline in pre-orders for mining equipment, with analysts predicting a slowdown in hash rate growth as the initial rush slows down.

The rise in hash rate over the past 18 months has been fueled by significant institutional investment in mining infrastructure. This increase in mining power is expected to continue, especially as the halving event approaches, but the impact of low transaction fees could pose challenges for miners.

Transaction Fees and Mining Profitability

One of the most important factors influencing Bitcoin mining profitability right now is the low transaction fees. Bitcoin’s transaction fees are currently at their lowest levels in years. A high-priority transaction in the Bitcoin mempool costs just 5 sat/vB ($0.69), marking one of the lowest fee levels in recent years. With fewer transactions generating high fees, miners are facing reduced revenue from transaction fees, making it more difficult to cover their operational costs.

Bitcoin’s long-term economic model relies on transaction fees eventually replacing block rewards as the primary source of revenue for miners. However, the current market conditions, including low transaction fees and increased mining difficulty, present challenges for this transition.

What’s Next for Bitcoin Mining?

The next difficulty adjustment is expected in four days, with predictions for an increase of over 6%. This adjustment will push the difficulty to a new all-time high, increasing the competition for mining rewards. With higher difficulty and reduced revenue from transaction fees, miners may face even more pressure to maintain profitability.

Get the Best Mining Equipment for Your Operations

As Bitcoin mining continues to evolve, it’s crucial to stay equipped with the right tools to remain competitive in this changing landscape. Explore our mining products and ensure you’re prepared for the upcoming challenges in the mining industry.