No products in the cart.

Bitcoin erases nearly all of its gains since Trump’s election, falling below $80K.

Bitcoin Drops Below $80,000 Amid Growing Macroeconomic Uncertainty and Trump’s Tariff Proposals

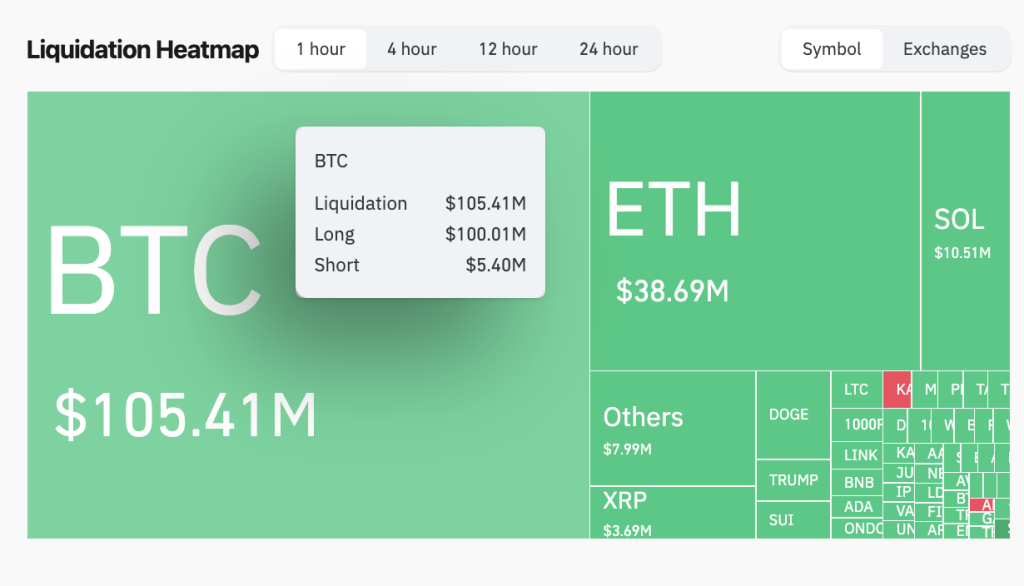

Bitcoin (BTC) has fallen below $80,000 for the first time in over three months, as rising macroeconomic concerns related to U.S. President Donald Trump’s proposed tariffs continue to impact the crypto market. On February 27, Bitcoin plummeted to $79,752, marking a 2.65% drop in just an hour, resulting in the liquidation of $100.01 million in long positions, according to data from CoinGlass.

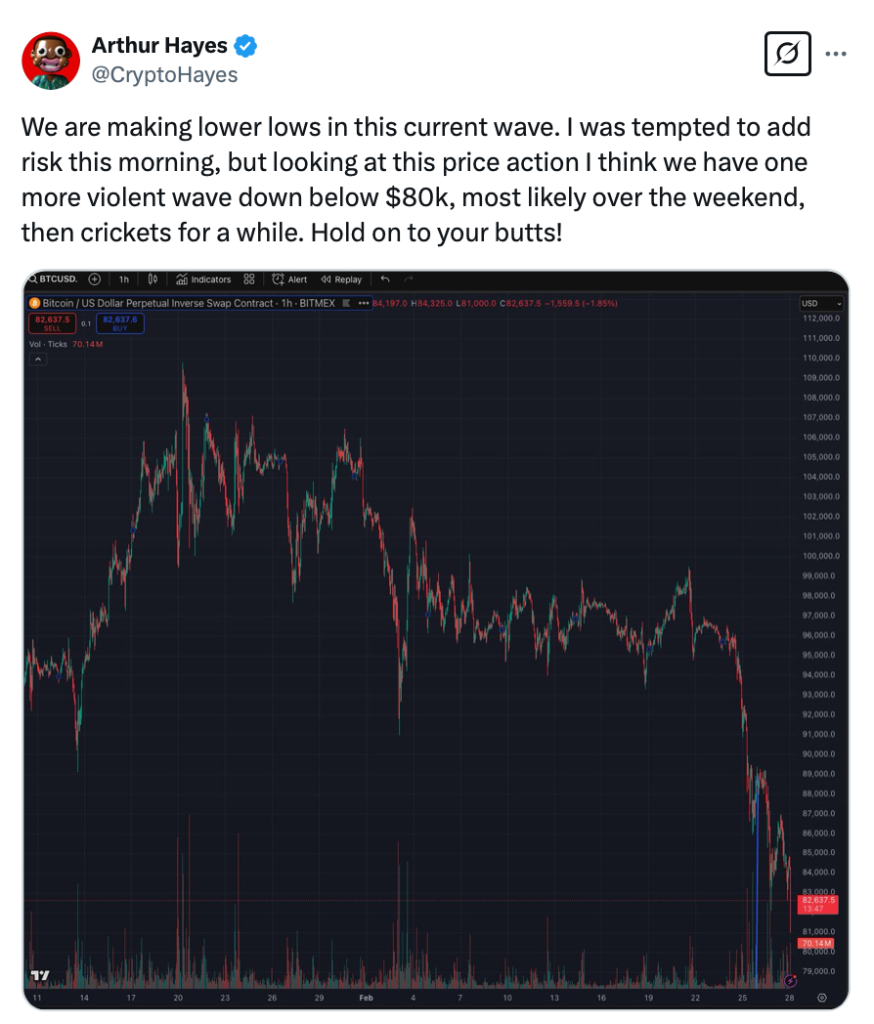

This is the lowest price Bitcoin has seen since November 11, 2024, shortly after Trump’s election as U.S. president. At that time, the market was filled with optimism about his pro-crypto policies, which many hoped would lead to a Bitcoin rally in 2025. Over the past few days, many traders expected Bitcoin to find support around the $82,000 mark, but there is now growing concern that it could fall further, potentially approaching $70,000.

Bitcoin’s Potential to Reach $70,000: Traders React to Decline

Crypto traders are bracing for further declines, with some now predicting that Bitcoin could dip to $70,000. Trader dmac shared in a post on February 27 that dip buyers have been unsuccessful, and they see $70,000 as the next potential target. Bitcoin hasn’t traded at this level since November 5, following favorable election polling results for Trump.

On the other hand, some traders like Mandrik remain somewhat optimistic, remarking that if investors liked Bitcoin at $80,000, they may appreciate it even more at $70,000. Another trader, Rager, reassured their followers that a drop to the mid-to-low $70,000 range wouldn’t be unusual, especially considering Bitcoin’s price cycles in past bull markets. Rager emphasized that drops of 30% to 40% are not uncommon during these market phases.

Data from crypto prediction platform Polymarket reveals a divided community, with nearly a 50/50 chance of Bitcoin continuing its downward trend or rebounding to higher levels. This uncertainty is mainly attributed to the broader macroeconomic climate and concerns over Trump’s proposed tariffs, which many believe have significantly contributed to Bitcoin’s recent decline.

Macroeconomic Factors and Bitcoin’s Recent Decline

Since Trump’s inauguration on January 20, Bitcoin’s price has dropped nearly 26%, from a high of $109,000 to its current level of around $79,000. Many experts point to the ongoing uncertainty surrounding Trump’s policies, particularly the proposed tariffs on goods from countries like China, Canada, and Mexico, as a key driver behind the market’s volatility.

Despite this recent price drop, institutional investors continue to show optimism about Bitcoin’s long-term potential. On February 27, Geoffrey Kendrick, Standard Chartered’s head of digital assets research, predicted that Bitcoin’s price could surge to $200,000 within this year and reach $500,000 before President Trump finishes his second term. This outlook reflects the growing institutional adoption of Bitcoin, despite short-term market fluctuations.

Bitcoin Mining: A Potential Source of Passive Income

Bitcoin mining presents an exciting opportunity for individuals looking to earn passive income. By mining Bitcoin, you contribute to securing the network and validating transactions while earning rewards in the form of newly minted Bitcoin. With the right equipment, mining can become a profitable endeavor, especially as the value of Bitcoin rises. While the process requires significant computational power and investment in hardware, it can be a worthwhile long-term investment for those willing to dedicate resources. If you’re interested in starting your mining journey, check out our collection of high-performance Bitcoin miners to find the perfect equipment for your needs.