No products in the cart.

Bitcoin May Reach $500K Before Trump Exits Office, Says Standard Chartered

Bitcoin Could Reach $500K Before Trump Leaves Office — Standard Chartered Predicts

According to Geoffrey Kendrick, Standard Chartered’s head of digital assets research, Bitcoin (BTC) could see a significant price increase in the coming years. Kendrick forecasts that Bitcoin will hit $200,000 within this year and reach as high as $500,000 before President Donald Trump finishes his second term in office. Kendrick attributes this optimism to the growing institutional adoption of Bitcoin and the potential for more clear regulations around cryptocurrencies.

Despite the volatility in the markets, Kendrick believes that Bitcoin’s price fluctuations will become less intense over time. As more institutional players enter the crypto space, the security risks that currently plague the ecosystem, like the recent $1.4 billion hack of the Bybit exchange, will be mitigated. Kendrick highlights the importance of traditional financial institutions, such as Standard Chartered and BlackRock, stepping up to offer more secure custody services for digital assets.

Bitcoin’s Recent Volatility and Price Dynamics

Bitcoin’s price has been incredibly volatile recently. It reached an all-time high of over $109,000 in January, only to drop to a more than three-month low of around $80,000. This sharp decline is largely attributed to President Trump’s renewed tariff threats against China and trade partners such as Mexico and Canada. Trump’s comment on Truth Social indicated that the tariffs on Canadian and Mexican goods would go into effect on March 4.

This price drop highlights Bitcoin’s growing correlation with the stock market and liquidity conditions. Market analysts, like The Kobeissi Letter, suggest that Bitcoin’s price is increasingly tied to broader economic factors. Bitcoin’s sharp fluctuations are common during bull markets, according to Global Macro Investor Julien Bittel, who notes that the cryptocurrency’s pullbacks often follow significant price increases, like the surge after the US presidential election.

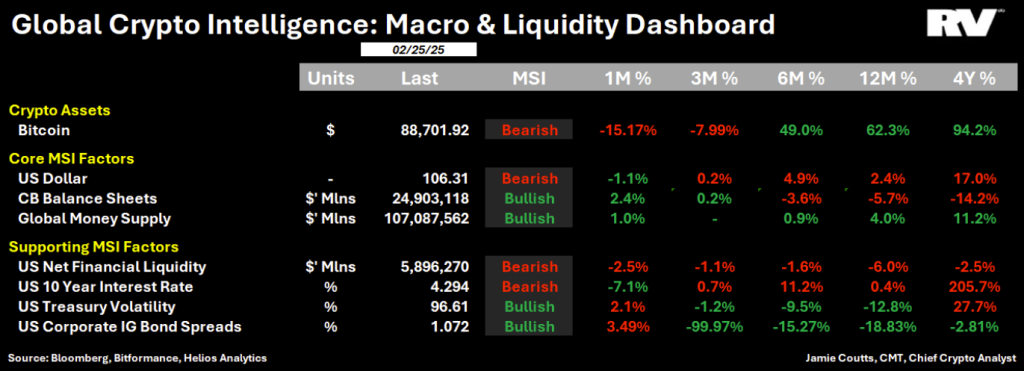

Meanwhile, Jamie Coutts, chief crypto analyst at Real Vision, noted that two of the three liquidity measures in his framework have turned bullish following Bitcoin’s recent sell-off. He predicts that expanding central bank balance sheets and a growing global money supply will support Bitcoin’s long-term price increase. The last element that needs to fall into place is a shift in the US dollar’s trajectory.

Bitcoin Mining: A Vital Part of the Crypto Ecosystem

Bitcoin mining plays a crucial role in maintaining the decentralized nature of the Bitcoin network. The process involves solving complex mathematical problems to validate transactions, secure the network, and add new blocks to the blockchain. In return, miners are rewarded with newly minted Bitcoin.

To mine Bitcoin, miners use specialized hardware known as ASIC (Application-Specific Integrated Circuit) miners. These devices are optimized for solving the cryptographic puzzles that secure the Bitcoin network, offering significantly higher performance than regular computers or graphics cards.

If you’re interested in getting involved in Bitcoin mining, it’s important to choose the right ASIC hardware that matches your needs. Explore our collection of top-tier ASIC hardware to begin your mining journey and maximize your mining efficiency.