Grayscale launches Bitcoin Miners ETF to offer BTC mining exposure

Grayscale Launches MNRS ETF to Provide Exposure to Bitcoin Mining Industry

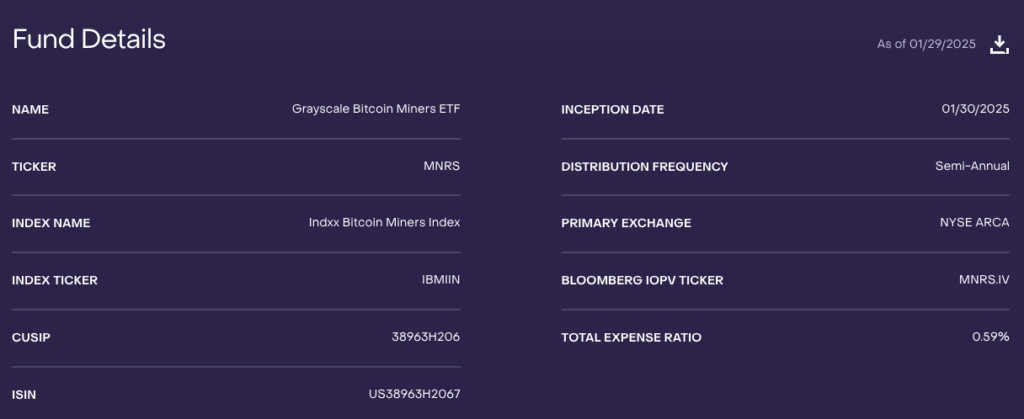

Grayscale, a prominent cryptocurrency asset manager, has expanded its range of crypto investment products with the launch of a new exchange-traded fund (ETF) that targets the growing Bitcoin mining industry. The Grayscale Bitcoin Miners ETF (MNRS), introduced on January 30, 2025, aims to offer investors the opportunity to gain exposure to Bitcoin miners and the entire Bitcoin mining ecosystem, without directly investing in Bitcoin itself.

The MNRS ETF is designed to invest in companies listed on the Indxx Bitcoin Miners Index, which tracks the performance of firms that derive the majority of their revenue from Bitcoin mining or related activities. These activities include the manufacturing and distribution of mining hardware, software, services, and other aspects of the mining sector. However, Grayscale clarified that MNRS does not directly invest in digital assets or derivatives, but may have indirect exposure to Bitcoin through its investments in mining companies.

The Role of Bitcoin Miners and Their Growth Potential

Grayscale’s new ETF reflects the company’s recognition of the critical role that Bitcoin miners play in supporting the Bitcoin network. According to Grayscale, Bitcoin miners are vital to the security, integrity, and continuity of the Bitcoin blockchain. As such, they are essential for the overall functionality of the network, making them a key focus for investors looking to diversify their cryptocurrency portfolios without direct exposure to BTC.

David LaValle, Grayscale’s global head of ETFs, emphasized that the Bitcoin Miners ETF provides targeted exposure to the global Bitcoin mining industry in a passively managed, rules-based, and index-tracked fund. LaValle stated, “As Bitcoin adoption and usage continue to grow, Bitcoin miners—the backbone of the network—are well-positioned for significant growth, making MNRS an appealing option for a diverse range of investors.”

Bitcoin Mining Stocks Struggling Despite Market Gains

Despite the positive outlook for Bitcoin miners, mining stocks have had a difficult time capitalizing on Bitcoin’s price growth. In late January, crypto mining stocks faced extended losses following a market downturn triggered by interest in DeepSeek’s new AI model. While Bitcoin saw an impressive 113% return in 2024, mining stocks struggled to keep pace, with many publicly listed miners finishing the year with significant losses. Data from Hashrate Index and Google Finance revealed that some miners saw their stock prices fall by as much as 84%.

Why Bitcoin Mining Remains a Profitable Venture

Bitcoin mining continues to be a profitable and crucial part of the crypto ecosystem. Mining involves validating transactions and adding them to the blockchain, which requires significant computational power and energy. As Bitcoin’s market continues to expand, the potential for growth in mining operations is considerable, especially for companies that invest in cutting-edge mining hardware and energy-efficient solutions.

If you’re considering entering the Bitcoin mining space or looking to upgrade your equipment, explore our ASIC Hardware to ensure your operations are optimized for maximum performance. To learn more about our mining hardware and how it can boost your mining efforts, visit our product page for detailed information.