Nvidia has become the most valuable publicly listed company in the world.

Nvidia has overtaken Microsoft and Apple to become the most valuable publicly traded company in the world.

The AI and graphics chip powerhouse now has a market cap of $3.34 trillion, slightly ahead of Microsoft’s $3.32 trillion and Apple’s $3.29 trillion valuations.

At the time of writing, Nvidia’s stock is priced around $135, following a 10-for-1 stock split that took place in June. Before the split, Nvidia shares were trading around $1,200.

The stock split was part of Nvidia’s strategy to make its stock price more accessible and increase its chances of being included in the Dow Jones Industrial Average, which tends to favor companies with more reasonably priced shares to prevent any single company from disproportionately influencing the index.

Nvidia’s Humble Origins

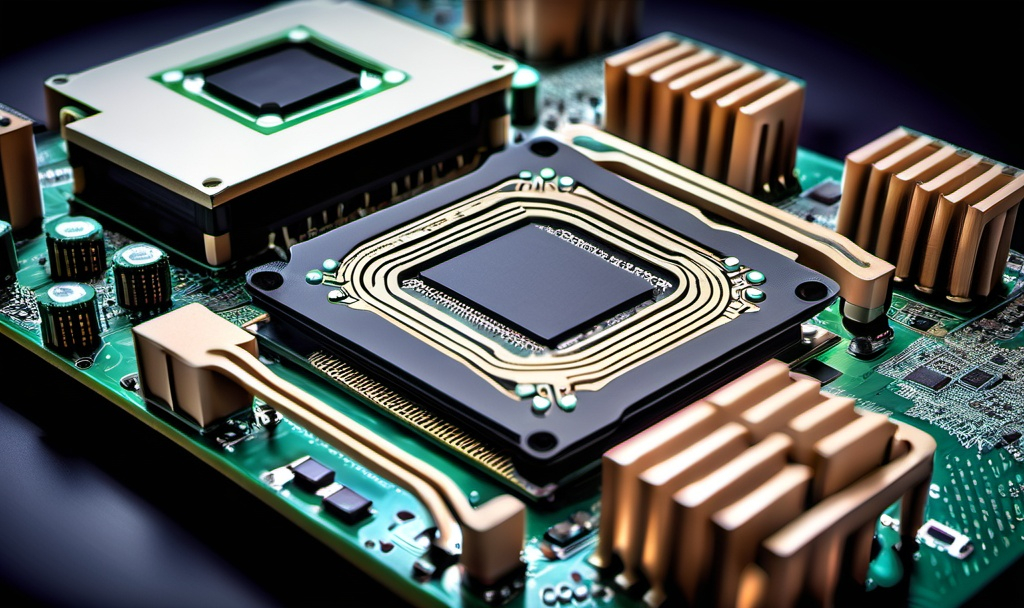

Founded in 1991, Nvidia originally focused on creating graphics cards for high-performance video gaming. Today, the company is a key player in building the technological foundation for the era of artificial intelligence.

The company’s rise was fueled by the surge in demand for its GPUs during the cryptocurrency mining boom that began in 2010, a trend that was eventually overtaken by the development of ASICs (application-specific integrated circuits) for proof-of-work mining.

The AI Race

Nvidia’s high-performance graphics processors have become the preferred choice for major players like OpenAI, Google, Amazon, and even Microsoft, all of whom rely on Nvidia’s chips to develop their AI infrastructure.

In its latest quarterly report, Nvidia announced impressive results, generating $26 billion in revenue, with $22.6 billion of that coming from its data center business.

These results prompted CEO Jensen Huang to announce that Nvidia will now release new AI chipsets annually, signaling what he described as a modern industrial revolution that will impact all sectors globally.

Previously, Nvidia launched high-end microprocessors every two years. For example, its Ampere architecture debuted in 2020, Hopper in 2022, and the Blackwell architecture was introduced in 2024.