Top 5 Digital Assets to Mine in 2025

The Ethereum merge of 2022 represented a major turning point in the cryptocurrency mining landscape, solidifying Bitcoin’s position as the leading cryptocurrency to mine. Bitcoin mining now constitutes the bulk of global cryptocurrency emissions, presenting significant opportunities for large-scale operations. However, for smaller-scale miners seeking alternatives to Bitcoin, there are several other cryptocurrencies that have demonstrated profitability.

Let’s take a look at the top five cryptocurrencies to mine in 2025.

1. SHA-256 (BTC, BCH)

Bitcoin continues to be the gold standard in cryptocurrency mining. Its Proof-of-Work (PoW) consensus mechanism offers attractive rewards, especially for large-scale miners who have access to affordable electricity and efficient hardware. The introduction of ASICs has propelled the network hashrate to record levels, making Bitcoin mining increasingly competitive. In 2025, advancements in cooling technology and the integration of renewable energy are further shaping the Bitcoin mining industry, solidifying it as the most secure blockchain network and a key focus for institutional mining operations.

2. Scrypt (DOGE, LTC)

Dogecoin and Litecoin both use Scrypt-based mining, enabling merged mining of both cryptocurrencies at the same time. This approach has made Scrypt mining especially attractive, as miners can maximize their rewards with the same computational resources. Dogecoin’s popularity, fueled by its meme status and high-profile endorsements, has significantly boosted its network hashrate. Litecoin, known for its faster transaction times and lower fees, remains a cornerstone of Scrypt mining. Together, these two coins have created a profitable ecosystem for miners, especially with the advent of next-generation Scrypt ASICs.

3. Kaspa (KAS)

Kaspa is gaining popularity in the mining community thanks to its faster confirmation times, making it an appealing choice for miners. Its visibility at major mining conferences and adoption by institutions like Marathon Digital Holdings underscore its increasing importance. Miners value its GPU-friendly mining algorithm, which presents significant opportunities for those utilizing mid-range hardware.

4. Ethereum Classic (ETC)

Ethereum Classic continues to be a viable option for GPU miners, especially after the original Ethereum network transitioned to Proof-of-Stake (PoS) in 2022. ETC preserves its PoW foundation, providing a familiar and profitable mining ecosystem for former Ethereum miners. With regular upgrades and ongoing development, Ethereum Classic has ensured network stability and usability. It remains a popular choice for miners who invested in high-end GPUs and wish to continue utilizing their hardware in a PoW environment.

5. Equihash (ZEC)

Equihash is a memory-intensive mining algorithm that powers cryptocurrencies like Zcash (ZEC). Known for its privacy features and shielded transactions, Zcash remains a leading choice for miners interested in Equihash. The algorithm’s resistance to ASIC dominance makes it especially appealing to GPU miners, promoting a more decentralized mining ecosystem. Other coins using Equihash also present opportunities, depending on network difficulty and market value. In 2025, advancements in GPU mining efficiency continue to bolster the profitability of Equihash-based coins.

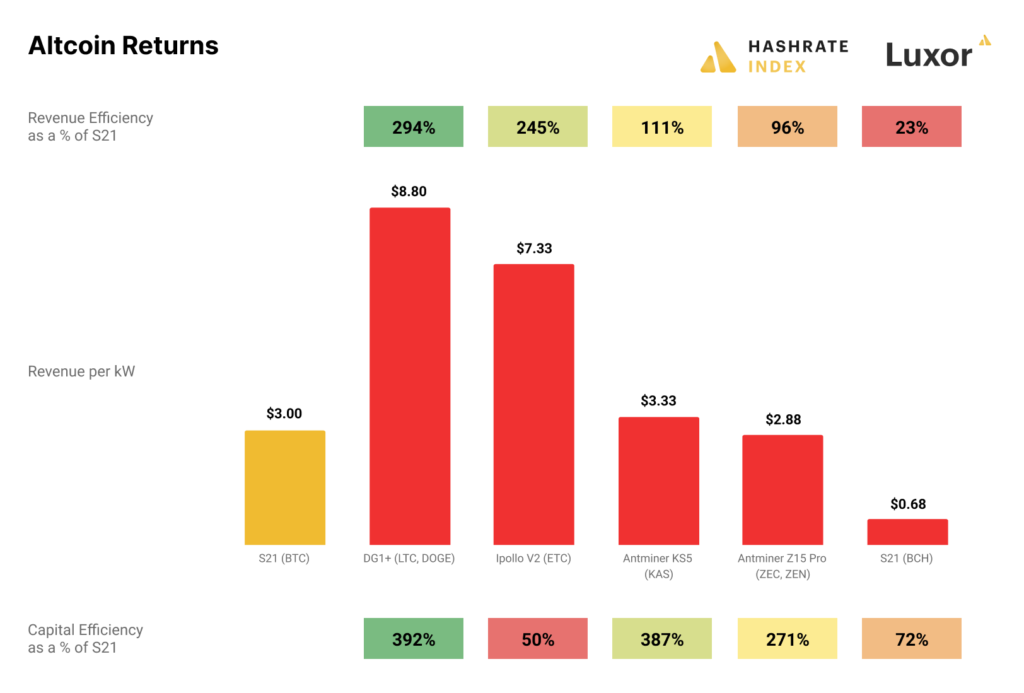

While the altcoin mining market is smaller compared to Bitcoin mining, some altcoins can be more profitable. However, this increased profitability comes with trade-offs, such as greater price volatility compared to Bitcoin, machine maintenance challenges, and limited after-sale support from manufacturers. Altcoins typically have higher capital expenditures (CapEx) but lower operational expenses (OpEx), making them an appealing alternative for miners.

Additionally, altcoin miners can take advantage of flexibility in their operations through tools like Luxor Switch, which allows them to switch dynamically between different cryptocurrencies to maximize profitability based on network conditions and market prices. This adaptability enables miners to optimize their returns while mitigating risks related to price fluctuations and network difficulties.

As the mining landscape continues to evolve in 2025, miners have diverse opportunities to innovate and succeed. Whether focusing on Bitcoin or exploring other options, strategic decision-making and adaptability will remain crucial for long-term success.

Why Bitcoin Mining Remains a Profitable Opportunity

Bitcoin mining continues to be a rewarding and integral part of the cryptocurrency ecosystem. The process involves confirming transactions and adding them to the blockchain, requiring significant computational resources and energy. With Bitcoin’s market expanding, mining operations have substantial growth potential, particularly for companies that invest in state-of-the-art mining equipment and energy-efficient solutions.

If you’re looking to enter the Bitcoin mining field or enhance your current setup, consider exploring our ASIC Hardware to ensure your operations are running at peak efficiency. For more information on how our mining hardware can elevate your mining operations, visit our product page.