Senator Warren doesn’t take the crypto bait in debanking hearing

Now under a Republican-controlled US Congress, the Senate Banking Committee focused its efforts on addressing claims the government “bullied” banks into halting services to crypto firms.

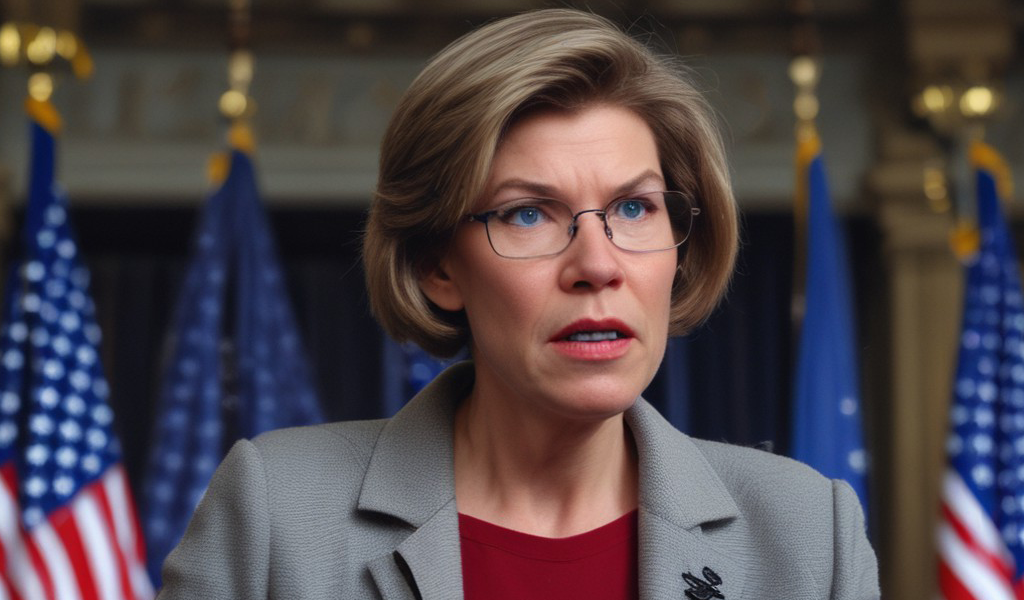

During a Senate Banking Committee hearing on debanking on February 5, Massachusetts Senator Elizabeth Warren notably avoided directly addressing cryptocurrency, despite the topic of the hearing involving allegations that U.S. government entities had pressured financial institutions to halt or suspend services to digital asset firms.

As the ranking member of the committee, Warren used her opening remarks to emphasize the thousands of complaints related to debanking, particularly those stemming from past incarceration, Muslim-American identity, or involvement in the cannabis industry.

She also questioned Nathan McCauley, co-founder and CEO of Anchorage Digital, about his experiences, and Aaron Klein from the Brookings Institution, asking how the Consumer Financial Protection Bureau (CFPB) could address “unfair debanking.”

“I don’t think for a second that you should be locked out of our banking system,” Warren stated, possibly referring to Anchorage, before continuing:

“If banks are adopting policies that routinely debank people based on their beliefs or other illegitimate reasons — that’s wrong, it needs to be stopped.”

In his written testimony to the committee, McCauley primarily provided his personal experiences and anecdotes as evidence that U.S. government officials were involved in a coordinated effort to debank crypto firms, often referred to as “Operation Chokepoint 2.0.” He stated that he had “spoken to dozens of crypto leaders” who had experienced debanking, either personally or within their companies, and expressed his belief that regulators had pressured banks to sever ties with the crypto industry.

Pivoting from crypto debanking claims

Under questioning from Senator Warren, McCauley stated that he didn’t think it would be “productive” to disclose which banks had refused to provide Anchorage with services after the firm’s account was threatened with closure in 2023. Warren pressed him on the appeals process following his account denials and whether regulators should create a database to track debanking claims. When McCauley mentioned crypto, Warren shifted focus to other individuals’ debanking experiences. Her remarks stood in contrast to those of Chair Tim Scott and other Republican senators on the committee, many of whom questioned the witnesses about claims that the Federal Deposit Insurance Corporation (FDIC) and the Securities and Exchange Commission (SEC) had used their authority to pressure banks into pausing or halting services to crypto firms.

A lawsuit led by Coinbase in June 2024 uncovered letters revealing that the FDIC had requested certain financial institutions to “pause” their crypto banking activities.

“For almost 3 years, this one-two punch by the FDIC and the SEC had the intended effect of preventing banks from serving as custodians of crypto and choking out banks from providing demand deposit services, which prevented banks from being the on-off ramp for legal crypto companies,” said Mike Ring, president, CEO, and co-founder of Old Glory Bank, in his written testimony for the hearing.

A similar hearing by the House Financial Services Committee, examining debanking claims, is set for February 6, with Coinbase’s Chief Legal Officer Paul Grewal and Fred Thiel, CEO of crypto mining firm MARA, expected to testify.