Bitcoin Hashrate Hits All-Time High Defying Analyst Expectations

Bitcoin transaction fees have hit multi-year lows despite the price hovering around $100,000.

Key Points to Know:

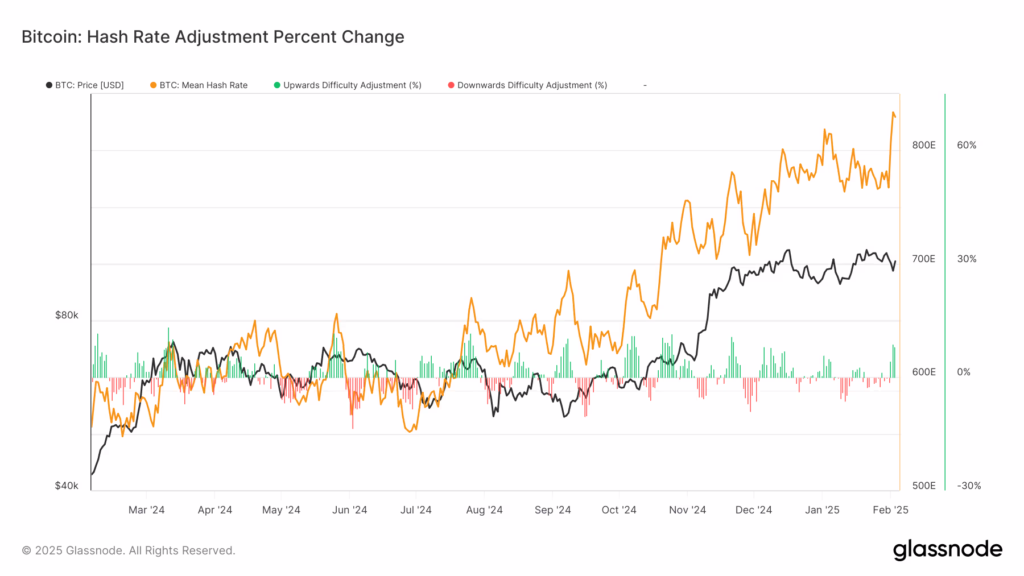

- The Bitcoin hash rate has reached a record high of 833 EH/s based on a seven-day moving average.

- Bitcoin transaction fees are currently at their lowest in years.

Bitcoin’s hash rate has set a new all-time high, with the seven-day moving average reaching 833 exahashes per second (EH/s), according to data from Glassnode. This marks a 9% increase from 767 EH/s in the last few days.

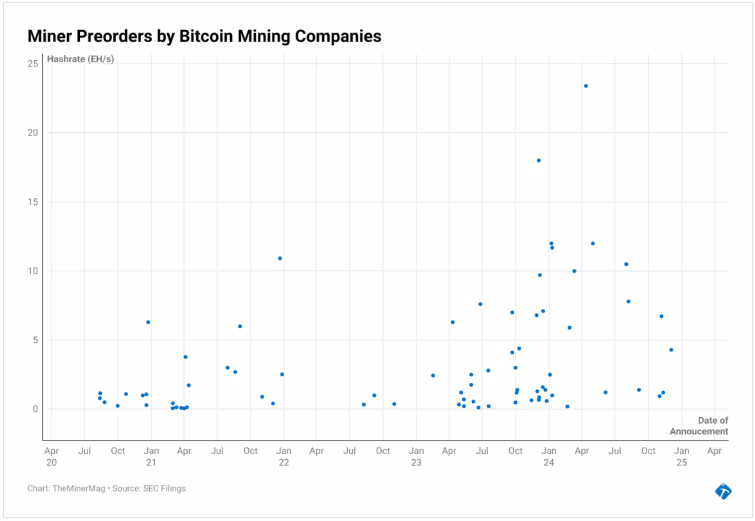

Miner Mag reports that pre-orders for mining equipment have started to decline after a surge leading up to the halving event. Many mining companies had stocked up on hardware in preparation, ensuring their operations would stay competitive, but analysts now predict a slowdown in the growth of hash rate.

The hash rate measures the computational power used to secure the Bitcoin network through mining, and a higher hash rate means increased network security.

The Miner Mag highlights that the network’s hash rate has risen significantly over the past 18 months, largely driven by institutional investment in mining infrastructure. This surge occurred ahead of Bitcoin’s halving in April 2024, an event that reduces the block reward by 50% approximately every four years. Since the halving, the hash rate has increased by more than 40%, signaling continued growth in mining operations.

The increase in hash rate has coincided with mining profitability remaining relatively stable in recent months. A key factor behind this is the historically low transaction fees, which have reduced the income miners receive.

Currently, a high-priority transaction in the Bitcoin mempool costs just 5 sat/vB ($0.69), marking one of the lowest fee levels in recent years. With fewer transactions generating fees, miners are earning less from transaction fees, which makes it harder for them to cover their operational costs.

Bitcoin’s long-term economic model is designed for transaction fees to gradually replace block rewards as the main source of revenue for miners. However, the current market conditions present challenges to this model.

Looking ahead, the next difficulty adjustment is set to take place in four days, with expectations of an increase of over 6%, which will push it to a new all-time high and put additional pressure on miners.